Top Guidelines Of Stonewell Bookkeeping

The Main Principles Of Stonewell Bookkeeping

Table of ContentsNot known Factual Statements About Stonewell Bookkeeping The 45-Second Trick For Stonewell BookkeepingStonewell Bookkeeping Things To Know Before You Get ThisThe Main Principles Of Stonewell Bookkeeping The Best Strategy To Use For Stonewell Bookkeeping

Most lately, it's the Making Tax Digital (MTD) initiative with which the federal government is expecting services to conform. franchise opportunities. It's precisely what it states on the tin - services will need to start doing their taxes digitally with using applications and software program. In this case, you'll not only need to do your books however likewise use an application for it.You can relax very easy knowing that your service' economic info is ready to be assessed without HMRC giving you any type of anxiousness. Your mind will be at simplicity and you can concentrate on various other areas of your organization.

The 9-Minute Rule for Stonewell Bookkeeping

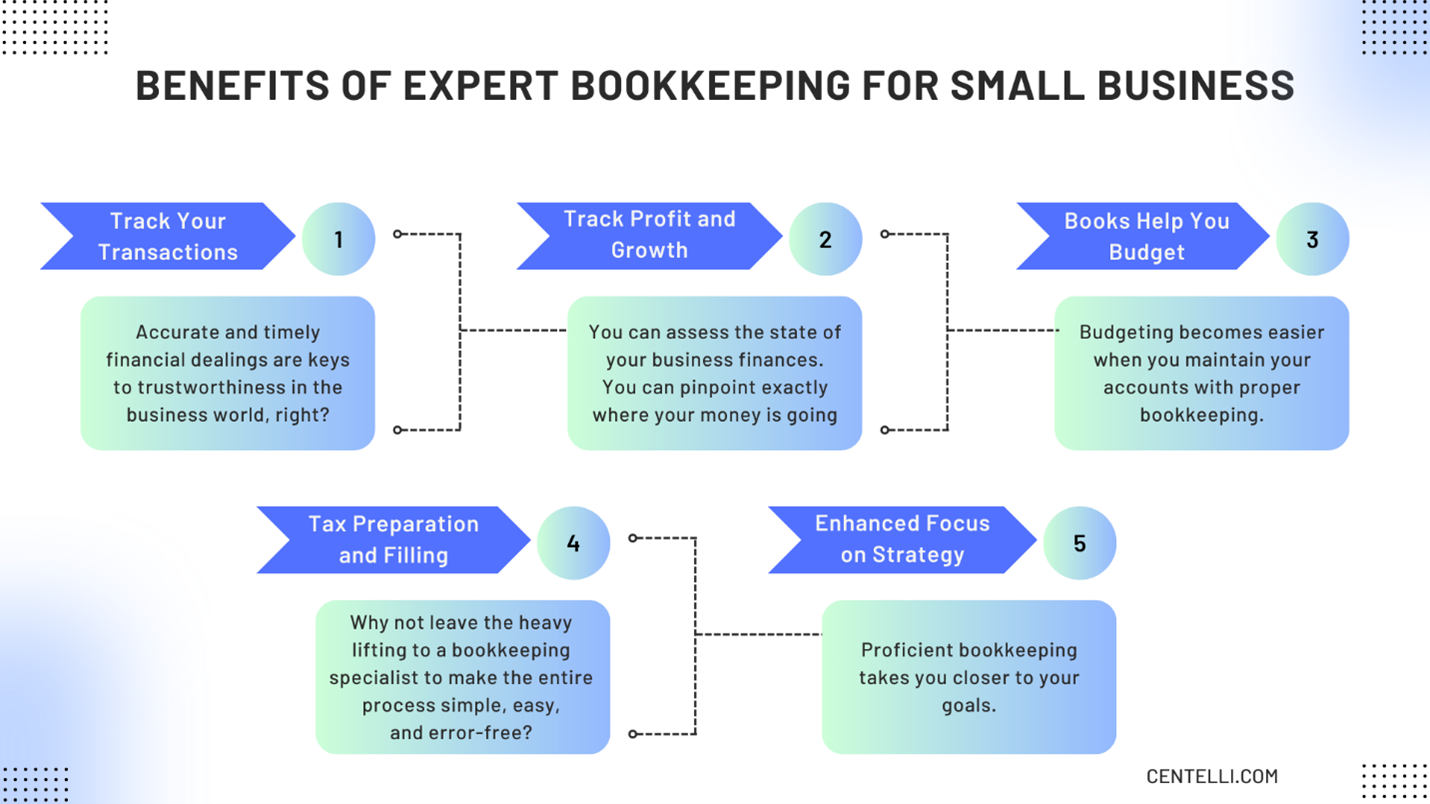

Bookkeeping is vital for a local business as it helps: Display financial wellness and make notified decisions, including cash flow. Adhere to tax obligation laws and stay clear of fines. Track expenditures and earnings, enabling recognition of areas for improvement. Boost credibility with lenders, investors and consumers. Mobile accounting apps use a number of advantages for small company proprietors and entrepreneurs, simplifying their monetary monitoring tasks.

Many modern accounting apps allow users to link their checking account directly and sync the transactions in real time. This makes it much easier to keep an eye on and track the income and expenditures of business, removing the need for manual entry. Automated features like invoicing, expense monitoring, and importing financial institution deals and bank feeds conserve time by lowering hands-on information entry and improving accounting procedures.

In addition, these applications lower the demand for employing extra staff, as numerous tasks can be managed in-house. By leveraging these benefits, local business proprietors can enhance their monetary administration processes, enhance decision-making, and concentrate a lot more on their core organization procedures. Xero is a cloud-based bookkeeping software program that helps local business quickly handle their accountancy documents.

That "profitable" customer may actually be costing you cash once you variable in all expenditures. It's been haemorrhaging cash money for months, yet you had no means of understanding.

The Single Strategy To Use For Stonewell Bookkeeping

Since they're making decisions based on strong information, not estimates. Your bookkeeping exposes which solutions or items are truly rewarding, which customers are worth keeping, and where you're spending unnecessarily. https://justpaste.it/izep4.

Right here's a practical comparison to help you determine: FactorDIY BookkeepingProfessional BookkeepingCostSoftware charges just (less costly upfront)Solution fees (typically $500-2,000+ regular monthly)Time Investment5-20+ hours per monthMinimal testimonial records onlyAccuracyHigher mistake risk without trainingProfessional precision and expertiseComplianceSelf-managed danger of missing requirementsGuaranteed ATO my website complianceGrowth PotentialLimited by your offered timeEnables concentrate on core businessTax OptimisationMay miss deductions and opportunitiesStrategic tax preparation includedScalabilityBecomes frustrating as business growsEasily ranges with business needsPeace of MindConstant worry about accuracyProfessional assurance If any of these audio familiar, it's most likely time to bring in an expert: Your organization is expanding and transactions are multiplying Accounting takes even more than five hours regular You're registered for GST and lodging quarterly BAS You use staff and handle pay-roll You have numerous earnings streams or bank accounts Tax season fills you with genuine fear You would certainly rather focus on your actual imaginative work The reality?, and professional accountants understand just how to utilize these tools efficiently.

The Ultimate Guide To Stonewell Bookkeeping

Maybe certain jobs have better payment patterns than others. Even if offering your business appears remote, keeping clean monetary records develops enterprise value.

You may additionally pay too much taxes without appropriate paperwork of deductions, or face troubles during audits. If you find errors, it's vital to fix them immediately and modify any type of afflicted tax obligation lodgements. This is where specialist accountants show indispensable they have systems to catch errors before they become pricey issues.

At its core, the main difference is what they do with your financial information: take care of the day-to-day tasks, consisting of recording sales, expenses, and bank reconciliations, while keeping your basic ledger up to date and exact. It has to do with getting the numbers right regularly. action in to analyse: they check out those numbers, prepare monetary statements, and analyze what the information really means for your service development, tax setting, and success.

Not known Facts About Stonewell Bookkeeping

Your company choices are only just as good as the documents you have on hand. It can be challenging for local business owner to individually track every expense, loss, and revenue. Maintaining accurate documents needs a great deal of job, also for local business. Do you recognize how much your service has invested on pay-roll this year? Exactly how about the amount invested on supply until now this year? Do you recognize where all your receipts are? Company taxes are intricate, time-consuming, and can be difficult when trying to do them alone.